Unprecedented times in the UK energy market

Wholesale energy prices are front page news right now, and you may be wondering why the UK energy market has been so volatile recently.

We all know you make better electricity buying decisions when you’re better informed. So, here’s a quick run-through of the factors that are affecting the price of energy at the moment.

What’s happening in the market?

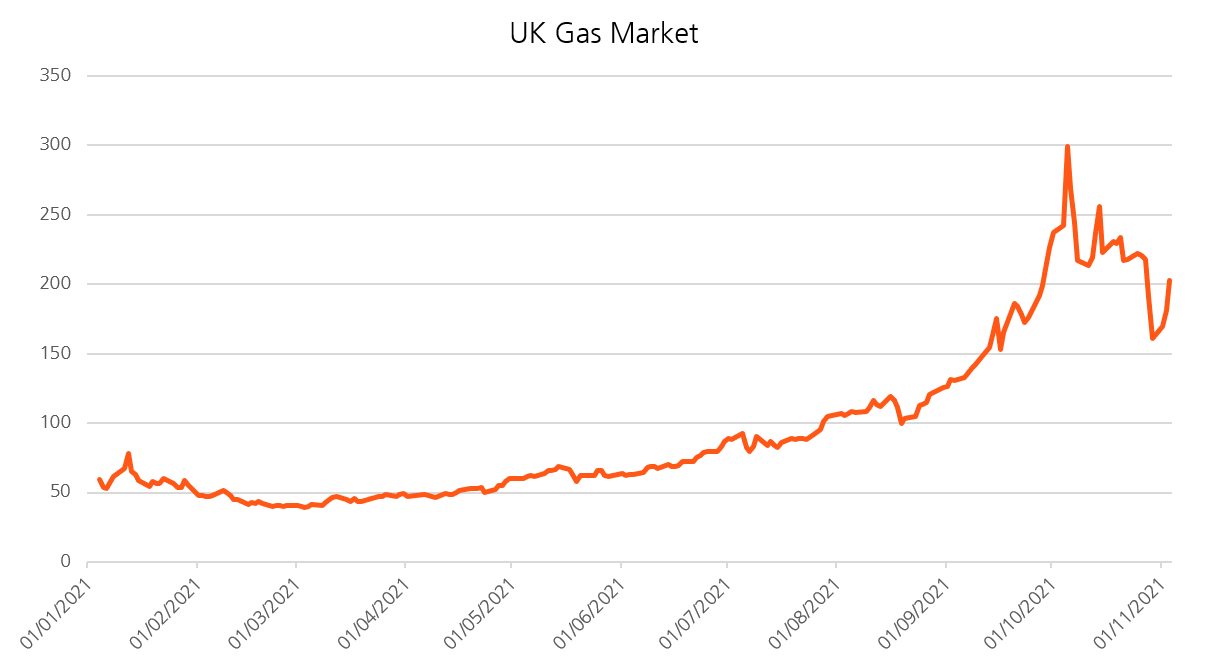

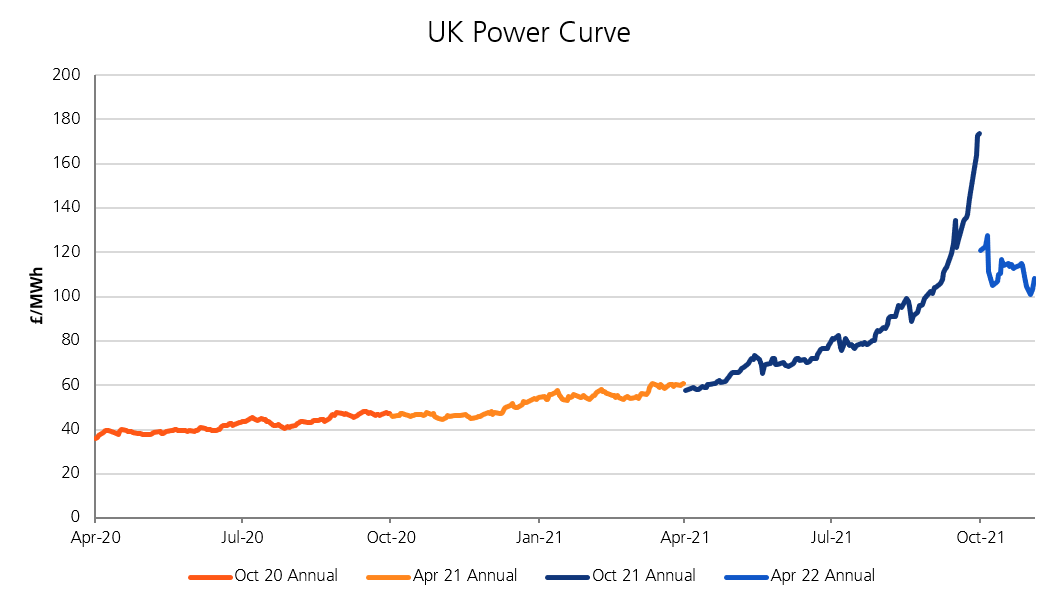

Wholesale prices around the world have been rapidly increasing over the last 6 months. With UK gas prices rising by approximately 28% in August alone.

So, why does this affect the price of electricity? It’s because we use gas to generate electricity in the UK.

Here’s how we make electricity here in the UK, it’s called our fuel mix:

| Coal | Gas | Nuclear | Renewable | Other | |

|---|---|---|---|---|---|

| UK average fuel mix | 2.7% | 38.2% | 16.1% | 40.3% | 2.7% |

This is for the period April 2020 to March 2021. As you can see, gas makes up a significant amount of the UK average fuel mix, so when the price of gas is high, so is the overall price of power.

Last winter we saw extremely cold temperatures, and not just in the UK, which led to an increase in demand for gas. Coupled with an unseasonably cold spring, gas storage facilities across Europe were left exhausted. Over the summer months, we typically buy gas to replenish our storage facilities to make sure we have enough supply during winter. But with the rest of the world doing the same, at the start of this winter our gas reserves are at the lowest they’ve been since 2013.

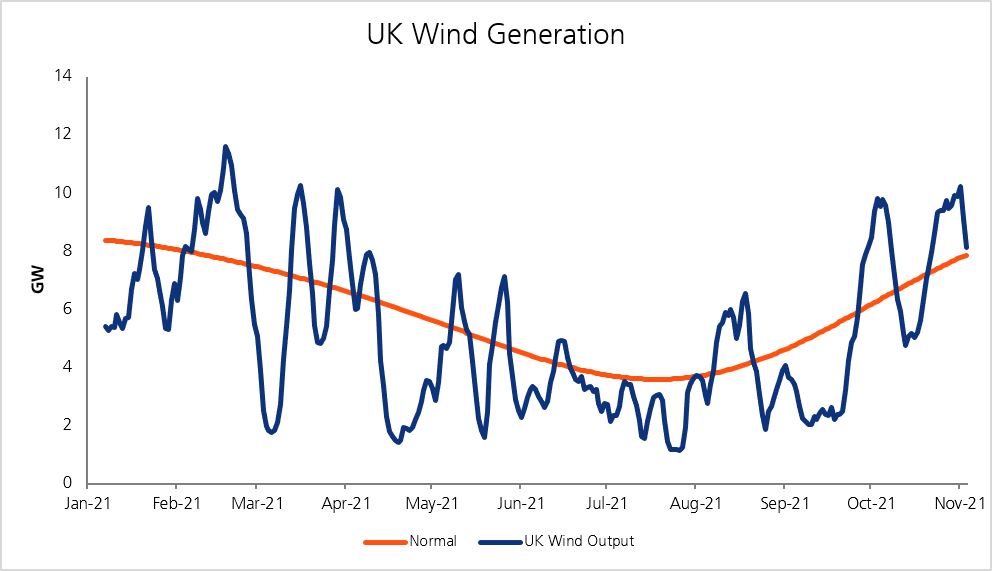

Alongside an unseasonably cold winter and spring, we’ve seen consistently low wind generation throughout the summer, meaning demand for gas has been higher than usual.

At the beginning of September there was an incident at the main interconnector between the UK and France that enables electricity to flow between the two countries. A fire at the site took out the entire station leaving it at only half capacity throughout winter. This means the UK will need to rely on more gas, and possibly even coal at peak times.

Other influences like outages in the North Sea; delays with a new gas pipeline (Nord Stream 2); and Russia prioritising their domestic market, leaving them unwilling to ramp up gas flows into Europe, also affect prices.

Another factor is CO2. CO2 emissions prices have increased by 25% in the last six months. What this means is that non-renewable generation technologies need to buy certificates for each tonne of CO2 that they generate. It’s not just a penalty but an effort to incentivise renewable generation. This big increase in the price of CO2 has also pushed power prices up.

There’s also the expected seasonal demand that sees prices increase in the colder and darker months when residential customers and businesses have the heating and the lights on more than in the warmer months.

All of these factors have driven up the price for electricity and gas here in the UK.

What else is affecting prices?

Changes to the way that transmission and distribution costs are charged are coming into effect from April 2022 as part of the Targeted Charging Review (TCR). These changes will ensure that the UK’s electricity grid is maintained and that it has resource to expand it in the future so that it can keep up with demand.

At EDF we’re including these costs in the standing charge as we believe it’s the most accurate way to pass these charges on.

When will we see prices drop again?

Unlike the domestic market in the UK, there is no technical cap on the wholesale power market, so there remains a lot of uncertainty as we go into winter.

If we see an early cold snap, not just in the UK, but Russia or Asia, or if we get low renewable generation, prices could go up further. Alternatively, if we get news of increased gas supplies into Europe from Russia, we could see prices reduce.

Prices for next summer and beyond are lower than winter 2021 at the moment, but risks around gas are focussed on the short term. If we have a cold winter, we may end up with very low gas storage in spring, putting increased pressure on injecting storage over the summer.

What does this mean for suppliers?

Energy suppliers, including EDF, use a practice called hedging to buy energy in advance for their customers and therefore avoid unexpected price increases. However, many small suppliers sold fixed price tariffs to their customers without buying enough energy in advance. This means they've had to pay extremely high prices and a growing number of these companies have now exited the market in the last few months.

We'll be onboarding customers from one of these companies, Utility Point, because Ofgem recognises us as a trusted supplier who's here for the long term.

So, don’t worry, we’re not going anywhere.

What can you do?

There are a few options – instead of renewing, you could allow your contract to drop onto out-of-contract rates to see if market prices decrease. But, out-of-contract rates can be amended at any time by your supplier, so you need to be very cautious if you choose this option, the rate you see today could increase tomorrow to reflect the market.

Signing a fixed price contract, however expensive it might look, does at least provide you with price stability for a period of time. However, make sure you read the terms and conditions of any fixed price contract you sign. Can the supplier unlock the contract at a later date and change those rates?

You can also look at how much energy you use and when you use it. You can reduce some of the impact of higher prices by simply using less energy. If you have the ability to control the times that you use your energy, you could see some significant reductions in the overall cost.

How would this work? Energy is priced on 48 half hour time slots each day. The price varies significantly for each 30 minute period. By far the most expensive time is between 4pm and 7pm on a weekday. At the moment, unit rates during this period are close to £1/kWh. So, if you can reduce your energy consumption in this 3 hour timeframe, you’ll make a saving. To benefit from this, you’ll need to sign a five rate structure contract - your Account Manager can talk you through this and how it works in more detail.

EDF have lots of ways that you can keep on top of what’s going on in the energy market. Sign up to our Market Insight platform for daily updates on energy prices, make sure you’re registered with MyBusiness to easily manage your account, and look out for more webinars from our team of experts.

Most important of it all, your Account Manager is always at the other end of the phone or email to answer any specific questions that you may have, we love hearing from you!