Business electricity buyer's guide 2021 - Part 1

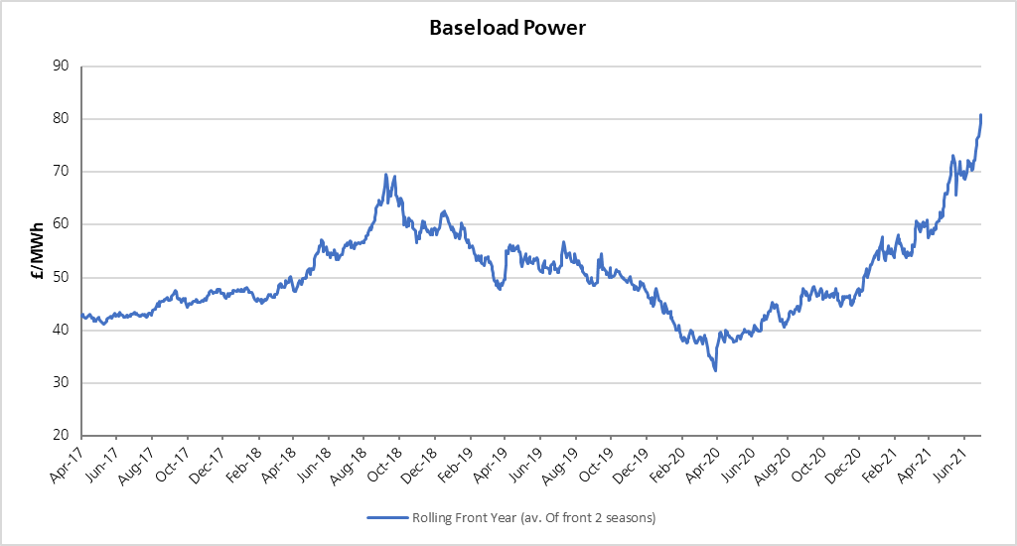

Looking for a new business electricity supply quote? I’m afraid you might be in for a bit of a shock. Wholesale power prices rose by 60% from April 2020 to April 2021 and have risen further since. As this feeds through directly into your next quote, your new price will probably be a lot higher than your current price.

What can you do to get your best electricity price? Read this buyer's guide.

Part 1 below will help you make sense of this price volatility, so you know how to spot when costs represent good value and it’s a good time to buy.

Part 2 lays out the energy buying techniques and strategies that will help you get the best deal for your business in these challenging market conditions.

Ready to get started? Read on for what to watch to keep track of the wholesale power price, helping you make the best buying decision.

Why the sudden focus on wholesale power costs?

Until recently, non-energy costs (the large group of transport and environmental charges) have dominated our updates about your future business electricity prices. And for two good reasons. In recent years non-energy costs have been increasing, at times making up around two thirds of your price.

But recent market volatility has reminded us that you can’t take your eye off the energy cost (the cost of power on the wholesale market). This is still the single biggest component of your electricity price and has almost doubled in the last 12 months.

How changes to wholesale power costs make a big difference to your quote very quickly

Here’s a quick explanation of how these two groups of costs feed through to the quotes we give you:

The wholesale power cost (energy cost) changes constantly but normally by small amounts. Sometimes though the movements can be large. For instance, with growing intermittent renewable generation and the lack of ways to store energy in the UK, when it looks like supply may struggle to meet demand the wholesale power price can spike. But regardless of whether the day to day movements are large or small, they instantly affect the electricity price offered to you by suppliers. That’s because your price reflects the wholesale power price on the day we quote you.

Non-energy costs are a bundle of charges, these tend to change less often but in larger jumps. However, over the past 12 months, the regulator has been reviewing some of these larger costs to make sure they’re both fit and fair for the current market. This has resulted in significant changes to the way that transmission, distribution and balancing costs (TNUoS, DUoS and BSUoS) are or will be charged going forward. These changes will have a huge impact on quotes you receive going forward.

What’s causing prices to rise? Will they rise further?

The question you should be asking now is: will the power price continue rising beyond £80/MWh as we approach next winter, or will prices fall?

Your answer lies in checking what we call market fundamentals – the main factors that cause wholesale power costs to rise or fall. There are many things that influence the overall fundamental outlook, however two key markets to monitor are gas and carbon.

Gas prices: The gas market is key in driving power prices as gas generation provides a large source of our supply and is generally our marginal generation unit. By this we mean the most expensive source of generation needed to meet demand.

Gas prices are impacted by the supply/demand balance, with weather a key driver to demand. Supply comes from a variety of sources, ranging from pipeline flows from the North Sea, to Liquefied Natural Gas (LNG). The current gas market has been left tight after a cold and prolonged winter. Gas storage levels are depleted, pipeline flows are down and there is competition for LNG cargoes with Asia. With this in mind, summer demand is set to remain elevated as storage sites restock, whilst there is risk we enter winter undersupplied. Sustained LNG supply will be needed over the coming months and there are hopes that a new Russian gas pipeline to NW Europe (Nord Stream 2) will come online, however many uncertainties remain.

The price of carbon: The cost of carbon relates to the tax levied on large emitters of CO2, including that from power generation assets (gas, coal). The carbon market has become ever more relevant over the past few years as the price surged higher, adding further premium to the UK power price, but why is this?

With the expectation of further regulation to tighten market supply, carbon prices have continually broken all-time highs. This has particularly been seen since November 2020, with prices doubling since on the news of more ambitious climate targets, with Europe and the UK setting stricter 2030 emission reduction goals. The UK has now seen its own carbon scheme launched and this has added some volatility to UK power contracts recently.

How to keep track

Market Insight: Use our online portal to track commodity prices and get the latest view from our analysts on what’s driving these. You can also get the latest wholesale power market prices alongside expert commentary in our fortnightly market pulse. We’ve created this handy infographic to help you get the most from the tool.

Talk to your account manager: Speak to us today to discuss your next contract. We have a range of contracts to suit your needs and help you make the right energy decision for your business.

Read Part 2 of our 2021 buyer's guide: Two insider tips and three buying strategies to help you deal with rising energy prices.