Lightsource bp and EDF collaborate on an innovative deal that offers flexibility to manage market risk

Lightsource bp is a global leader in the development and management of international large-scale solar projects and smart energy solutions.

A huge challenge for investors in new renewable assets is the management of power price risk. In the absence of government subsidies, the focus on power price is more acute and critical to enabling the building of new solar generation. In particular, the risk that the major source of income falls so low that the project becomes uneconomical.

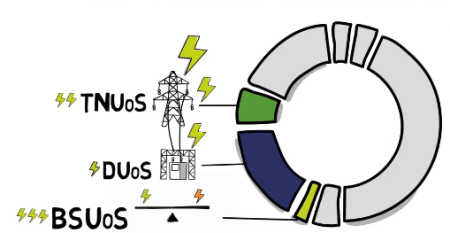

EDF and Lightsource bp have structured a PPA which provides the agility, flexibility and simplicity to manage that market risk. EDF will take care of output intermittency, balancing and price volatility. Lightsource bp will choose the timing of their power hedges to give their investors a desired return and risk profile. Each party focuses on what they’re good at.

What’s really important is that Lightsource bp can hedge their price risk very quickly if the market starts to move. They also need to know exactly what they will receive for every single MWh they generate. And that’s precisely what they’ve got. Clever but simple at the same time.

“We are very happy to be partnering with EDF and can draw on their expertise to create additional routes to market for solar in the UK. The team have created a product for us that suits the direction of our business, contributing towards our business goals to further realise the potential for large-scale solar in the UK.”

- Zosia Riesner, Director of Power Markets, Europe